Category: Newsletters

YML Insight June 2015

From Your Trusted Accountant

What does the $20,000 small business immediate deduction in the recent budget really mean?

Since the 2015 budget announcement, we’ve received many questions about theimmediate write-off of assets less than $20,000 for small business (effective from 7.30pm on 12 May 2015 until 30 June 2017). To help you understand how this will work, we’ve outlined some key points to start from. Remember, YML Group can always offer assistance, tips, and tricks to best manage your small business.

The $20,000 immediate deduction means:

1. You need to be ‘in business’ with an annual turnover of less than $2 million to

qualify for this concession.

2. You can you claim the deduction on as many assets as you have purchased,

provided they are under $20,000 each.

3. Any assets valued at $20,000 or more will be added to the small business simplified

depreciation pool (“the pool”) and depreciated at 15% in the 1st year, and 30% each

year thereafter. As soon as the balance in “the pool” is less than $20,000, you can

claim an immediate deduction at the end of the year between 12 May 2015 and 30

June 2017.

4. All new and second hand assets are eligible for this concession. There are some

exceptions on certain assets, as listed below:

a. Horticultural plants

b. Capital works – subject to their own ‘capital works’ depreciation rules

c. Assets allocated to a low-value pool or software development pool

d. Primary production assets

e. Assets leased out to another party on a depreciating asset lease

5. If you are registered for GST, the GST exclusive amount is taken to be the cost of

the asset. If you are not registered for GST, then the GST inclusive amount is taken

to be the cost of the asset.

Last but not least:

This is a tax deduction for the business, not a tax refund. You will get a tax deduction for the expenditure on the asset; this should reduce the amount of tax payable, at your marginal tax rate. You won’t get back the $20,000 – you just save having to pay tax on that amount.

If you have any questions, please don’t hesitate to call our accountants at YML Group.

From Your Finance Specialist

As a business owner, what’s the best way to secure a loan?

Running a business, big or small, can be a complex undertaking. Juggling expectations, financial commitments, service standards, and a range of other constantly shifting priorities leaves many business owners with little time to attend to the smaller details. Like, loan conditions, for example. If you have an existing business loan you should check the interest rate on the loan.The best way to secure your loan is to borrow against your property at residential loan rates, which can be 1.5% cheaper than business loan rates. Your current loan, even though it may be secured by your property, may actually be at business loan rates.

At YML Group, we provide assistance in all aspects of securing or renegotiating financing or loans. We can arrange your business finance at home loan rates, save you money and help with your cash flow.

To learn more about how we can assist you with your business financing arrangements, call us for an appointment today.

From Your Financial Adviser

What do I need to consider when putting my Estate Plan in place?

Discussing the harsher realities of life such as an Estate Plan can be difficult. Many people avoid this topic and don’t have a current plan in place. Unfortunately, not having a plan can be devastating to family, and an incorrectly set-up plan can be very costly (taxed unnecessarily).

You need to plan your estate to ensure your assets are inherited, with as little tax impact as possible, by the people you want to receive them.

Your estate should be governed by your Will, which should be up-to-date, and correctly reflect your wishes. Even if you don’t have many assets, having a Will can save your beneficiaries, family and friends a lot of trouble and heartache.

Your Will needs to:

* Be drawn up by a reputable solicitor with your or your financial adviser’s input.·

* Appoint a Legal Representative or Executor who accepts the responsibility.

* Detail your assets and personal affects accurately – this makes it easier to

administer.

* Offer clear instructions for how you wish the assets/property/valuables

administered. ·

* Include your funeral arrangements – leaving instruction makes it easier for your

family to deal with.

* Consider organ donation – if that is what you wish to do.

* Be kept in a safe place but easily found if needed.

Superannuation death benefits may not be part of your Will

Unless you specifically chose to have your superannuation death benefits dealt with by your Legal Representative (therefore your Will), they will be administered by the trustees of your superannuation fund.

To avoid any confusion and complications you should consider giving a binding or non-lapsing death nomination to the trustee of your superannuation fund.

Power of Attorney

Another important element to your estate plan is to have a power of attorney in place. This legal document appoints another person to make legal and/or medical decisions on your behalf. It is particularly useful should something happen, such as a bad accident, where you are temporarily or permanently unable to sign documents.

Do you need a Testamentary Trust?

You most likely do if you have minor children or other dependants. This is a trust created in a person’s Will, which is activated upon the death of that person. Instead of assets passing directly from one person to another, the assets are passed to the Testamentary Trust and then administered by the designated trustee – usually a family member, a trustee company, accountant or solicitor.

Estate planning can be complex and it’s recommended you seek professional advice and assistance of both a financial adviser (who understands the intricacies of superannuation) and a solicitor experienced in such matters.

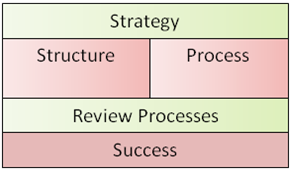

From Your Business Partner

How can I support quality, service, and performance in my small business?

If you don’t make the rules, people will make their own!

It’s truly surprising how many businesses that evolve from sole traders or micro businesses continue to grow solely on the back of the hard work of the principal. Many small business owners spend so much time working in their business, they leave themselves no time to work on their business. This means they do not find time to establish the quality, service and performance standards they require from others for continued success and growth in the business.

Most staff not only need, but also want, a guiding hand. Employees want to perform at an acceptable level and exceed expectations when possible; both for themselves and their employer. Failure by an employer to provide this guidance mean that staff may create their own standards, which are unlikely to align with those of the employer or the needs of the business and its clients.

It is essential that all businesses provide the right structure and processes to support defined quality, service and performance standards. Getting this right should:

* Provide the basis for a happier work force;

* Translate to better service to clients and therefore more success financially; and

* Position the business to manage resulting growth.

By clearly defining positions within the organisation and incorporating the roles, responsibilities and performance standards, the business Structure will not only support the existing business, but also provide a road map for operating a much larger entity as the business grows.

Quality processes support the business structure by clearly defining performance standards for each role.

Together, we call this our Performance Management System.

YML Group can work with you to create a performance management system tailored to your needs by focusing on the financial and non-financial activities within your business. We identify key business drivers and roadblocks, aligning your business strategy with both short and long term activities. We develop structured activity processes, providing you with control, and direction to achieve your strategy. Our monitoring processes ensure that results are achieved and plans are realigned as needed.

2015 Federal Budget Report

The Federal Treasurer, Mr Joe Hockey, handed down his second budget at 7.30pm (AEST) on Tuesday 12 May 2015.

In general, the budget is aimed at supporting small business and growing jobs ($5.5 billion including $5 billion of tax relief), supporting families ($4.4 billion funding boost), ensuring fairness of tax and benefits, national security and progressing budget repair in a measured way.

The full Budget papers are available at http://www.budget.gov.au/index.htm and the video can be watched athttps://www.youtube.com/watch?feature=player_embedded&v=g92lL1haUk8

Overview of the Budget

Small Business (Aggregated Annual Turnover less than $2 million)

- Small companies will have a 1.5% tax cut (from 30% to 28.5%) from 2015/2016 tax year.

- An unincorporated small business (ie: sole trader, partnership, trust) will receive a 5% tax discount on income earned from business activities from 1 July 2015. This discount is capped at $1,000 per individual for each income year and delivered as a tax offset.

- Immediate tax deductions for assets purchased and ready to use up to $20,000 from 12/5/2015 to 30 June 2017 (simplified depreciation rule applied).

- New start-ups will be able to claim an immediate deduction for professional expenses associated with the start of the business from the 2015/2016 year.

- From 1 April 2016, FBT exemptions will apply to work- related portable electronic devices (ie: laptop, mobile phone etc)

- Primary producers will be able to claim accelerated depreciation for water facilities, fodder storage and fencing from 1 July 2016.

Individual and families

- Changes to work related car expenses in 2015/16

- 12% original method and 1/3 actual expense method will be abolished

- Flat set rate of 66c per km for cent/ km method

- Log book method remains the same

- Working holiday maker will be treated as non-residents and taxed at 32.5% from 1 July 2016

- Medicare levy for low-income threshold changes from 1 July 2014

- Single- $20,896 ($20,542 for 2013/2014)

- Families- $35,261 and additional dependant will be an additional $3,238

- Seniors and pensioner- $33,044 ($32,279 for 2013/2014)

- No zone offset for fly in fly out employees

Family Package

- Child care system reform from 1 July 2017

- Annual household income up to $60,000 will be eligible for a subsidy of 85% of the actual cost paid, up to an hourly fee cap

- Annual household income of $165,000 will be eligible for a subsidy of 50%

- Annual household income of $180,000 and above, the child care subsidy will be capped at $10,000 per child per year

- From 1 July 2016, the existing parental leave pay (PLP) scheme, in addition to any employer- provided parental leave entitlement, will be removed.

The government will ensure that all primary carers would have access to parental leave payments that are at least equal to the maximum PLP benefits (currently 18 weeks at national min wages) - Family Tax Benefits (FTB) Part A large family supplement will cease from 1 July 2016

- From 1 Jan 2016, families will only be able to receive Family Tax Benefits (FTB) Part A for six weeks in a 12- month period while they are overseas.

Superannuation

- Early access to superannuation: people with a terminal medical condition, effective from 1 July 2015, can gain unrestricted tax- free access to their superannuation fund (must have two medical practitioner (including a specialist) certify that they are likely to die within one year).

Others

- Reversed charge rule for going concern and farmland sales mechanism will not proceed (remains at GST- free).

- GST compliance: Government will continue to provide funding of $265.5m over the next three years from 2016/2017 to promote the GST compliance.

- New multinational anti- avoidance rule to be introduced.

YML Insight April 2015

From Your Trusted Accountant

How Can I get Organised for the Tax Season?

1. Understand what you can claim from the beginning, which is largely depends on

the type of job you have. Ask us if you are not sure;2. Have your tax related paper work in a designated place and organize your records

into the following categories:

- Wages

- Other Income

- Car Expenses

- Travel Expenses

- Uniform Expenses

- Self education expenses

- Other Expenses (books, home office, telephone, computer, internet, stationery)3. Keep receipts to prove your claims and organise them by putting the receipts

for each category in a clearly marked separate envelope;

4. Don't forget if you claim more than $300 in deductions you will need to keep your

receipts for at least 5 years;

5. Enter your expenses into a spreadsheet monthly;

6. Schedule a time to meet with us to go through this year's paper work and see how

we might be able to structure your accounts to better help you organise your finances;

7. Book a meeting with our Financial Advisor to discuss the best way to structure your

assets and debts.

1. Understand what you can claim from the beginning, which is largely depends on

the type of job you have. Ask us if you are not sure;2. Have your tax related paper work in a designated place and organize your records

into the following categories:

- Wages

- Other Income

- Car Expenses

- Travel Expenses

- Uniform Expenses

- Self education expenses

- Other Expenses (books, home office, telephone, computer, internet, stationery)3. Keep receipts to prove your claims and organise them by putting the receipts

for each category in a clearly marked separate envelope;

4. Don't forget if you claim more than $300 in deductions you will need to keep your

receipts for at least 5 years;

5. Enter your expenses into a spreadsheet monthly;

6. Schedule a time to meet with us to go through this year's paper work and see how

we might be able to structure your accounts to better help you organise your finances;

7. Book a meeting with our Financial Advisor to discuss the best way to structure your

assets and debts.

From Your Finance Specialist

What do I need to look for when I borrow money to buy a new car?

When borrowing to buy a new car, it is more important to look at the monthly repayments than the interest rate. This way you can insure that the rate you are getting is real.At YML Finance, we can arrange car loans and other equipment finance from 4.8%.Please call us so we can let you know what your monthly repayments will be for your new car.

When borrowing to buy a new car, it is more important to look at the monthly repayments than the interest rate. This way you can insure that the rate you are getting is real.At YML Finance, we can arrange car loans and other equipment finance from 4.8%.Please call us so we can let you know what your monthly repayments will be for your new car.

From Your Financial Adviser

Do I need a wealth creation strategy?

Although a cliche, it is true that most people don't 'plan to fail', they simply 'fail to plan!'Unless you are a successful business owner aiming to cash out one day and ride off into the sunset, the quality of your retirement will largely depend on how you manage your cash flow and build assets from here on.

Apart from the lack of planning we often see inefficiency and expensive mistakes in people's personal structures. From personal and business loans that are incorrectly set up costing unnecessary interest and tax, to not using available collateral to build further assets for the longer term. Added to that, superannuation is often ignored.

What are the medium to longer term financial goals for you and your family? Once answered, develop a strategy that is simple, realistic and measurable!

We would welcome the opportunity to discuss and assist with your future wealth creation strategies.

Although a cliche, it is true that most people don't 'plan to fail', they simply 'fail to plan!'Unless you are a successful business owner aiming to cash out one day and ride off into the sunset, the quality of your retirement will largely depend on how you manage your cash flow and build assets from here on.

Apart from the lack of planning we often see inefficiency and expensive mistakes in people's personal structures. From personal and business loans that are incorrectly set up costing unnecessary interest and tax, to not using available collateral to build further assets for the longer term. Added to that, superannuation is often ignored.

What are the medium to longer term financial goals for you and your family? Once answered, develop a strategy that is simple, realistic and measurable!

We would welcome the opportunity to discuss and assist with your future wealth creation strategies.

From Your Business Partner

I am working hard so why I am not making a decent profit ?

If you always seem to be working, but are not achieving a result, it could be that you are spending too much time working in your business and not enough quality time working on your business.Having your own business is not about creating an 80 to 100 hour per week job, just for you. It is about creating a balance between life and work with results that exceed a normal PAYG income.

To manage your time effectively and to operate an efficient and growing business is a combination of good planning, a supportive operating system and regular performance reviews.

We can help you to build the foundation for a sound business that will allow you to

* set realistic financial and operational targets;

* develop an operational system to deliver the targets; and

* Implement a review process to ensure that issues are dealt with promptly.

We would like you to be successful and achieve your goals. We are happy to assist you start the process. We offer you an obligation free discussion on the health of your business and how our tailored system can help you.

If you always seem to be working, but are not achieving a result, it could be that you are spending too much time working in your business and not enough quality time working on your business.Having your own business is not about creating an 80 to 100 hour per week job, just for you. It is about creating a balance between life and work with results that exceed a normal PAYG income.

To manage your time effectively and to operate an efficient and growing business is a combination of good planning, a supportive operating system and regular performance reviews.

We can help you to build the foundation for a sound business that will allow you to

* set realistic financial and operational targets;

* develop an operational system to deliver the targets; and

* Implement a review process to ensure that issues are dealt with promptly.

We would like you to be successful and achieve your goals. We are happy to assist you start the process. We offer you an obligation free discussion on the health of your business and how our tailored system can help you.YML Insight March 2015

| From Your Trusted Accountant | |

| Why should I consider creating a new entity? | |

| Formalize informal partnerships Business partnerships are ticking time bombs as you are responsible for the actions of your partner. But unlike a joint account, a lawsuit against your partner can put all of your assets at risk. Form an entity to provide you with legal protection.Create business entities to shield assets If you have a small business or do part-time work on the side without having a formal business structure, you are operating as a sole proprietorship. The “sole” means it’s just you, but all of your personal assets are at risk if you are sued. Create a business entity that shields your personal assets from lawsuits against your company.A new entity could also allow wealth creation and better tax planning. |

|

| From Your Finance Specialist | |

| How do I borrow for my business and get a cheap home loan rate? | |

| Many business owners who are looking for a business loan, let the bank take their home/ investment property as a security.Business rates are usually 1%-1.5% higher than normal home loan rates. On a Million dollar loan we can save a client $10k-$15k per year! If you pay the higher loan rate, we can help you refinance to receive a cheaper loan rate.

|

|

| From Your Fincancial Adviser | |

| Where is my super? | |

| If you have held several jobs over your working life chances are you have a number of superannuation accounts you know little about. You should consolidate them, save on unnecessary fees and have the combined funds invested in the correct portfolio. Personal insurance policies may be offered by these accounts, so before your consolidate, these need to be analysed. We, the financial planning division at YML Group, will be glad to assist in this. |

|

| From Your Business Partner | |

| How can I understand how my business is performing at a glance? | |

| Understanding my business at a glance is not just possible but is essential in making efficient informed decisions.A combination of historical and forecast information, condensed into a dashboard report that is prepared daily or weekly, allows you to see how the business is performing.Focussing on key business drivers such as sales, cash flow and significant costs can minimise surprises at month end and prevent poor decisions affecting the business over the longer term.

A dashboard report tailored specifically to your business needs, that is reviewed and updated at regular management meetings is an essential tool in any business. |

|

YML Insight February 2015

From your Finance Specialist

How much can I borrow?

To know how much you can borrow without changing your lifestyle, check how much you can save per week after paying all your bills.

For every $100 savings you can borrow approximately $70,000. Include the rent you are currently paying as a saving as when you move to the new property you will no-longer pay it.

This rough estimation will ensure you do not over-commit. This week’s rate starts from 4.6% variable (not honeymoon loan), depending on the loan amount. The fixed rate starts from 4.59%.

From your Trusted Accountant

How do I save on my tax?

The first step is to choose the right entity structure as this could not only help you save on tax, but also provide flexibility and asset protection.

What can a claim as a deduction?

Donations to registered charities, management fees paid to a financial planner and/ or tax agent, cost of income protection or sickness and accident insurance premiums,

work related expenses including books, magazines, uniform, equipment, parking, tolls, taxis, public transport, etc. If you are maintaining a home office you can claim the cost of electricity,

internet, home phone, mobile etc, depending on how many hours per week you spend working from your home office.

From Your Financial Adviser

Do you have a savings goal, or a plan to reduce your mortgage this year?

Do you and your family know how you spend your after tax money each month? Why not start the year reviewing your household budget and get to understand just exactly where all the money goes.

We suggest, with a glass of wine in hand, spend some time one evening with your spouse reviewing your spending. If you would like we can assist you with our online tool.

From your Business Partner

Why do I need a CFO?

Maintaining books for your business is purely a gathering of information. It is what you do with that information that counts. The CFO is the sounding board for your business and develops the relationships

needed to ensure the confidence of you banks, investors, suppliers and the ATO. The CFO will be your link between the historical results and planning and strategy.

The CFO will partner with you to ensure that you have the accurate and timely information to make informed decisions. If you don’t need a full time CFO think about outsourcing options. page…

Federal Budget 2014-15 Update

On Tuesday 13 May 2014, the Commonwealth Treasurer, The Honourable Joe Hockey MP delivered Australia’s 2014 Federal Budget.

This year, the Budget announcement has garnered particular attention following a recent change of government and the recommendations of the National Commission of Audit.

In essence, the government ‘s strategy centres on expenditure savings in the areas of health services contribution, foreign aid, education, loan programs, family and other welfare benefits. Coupled with the reintroduction of fuel excise indexation and a personal tax increase.

Health

All Australians to pay at least $7 for GP visits, blood tests and X-rays.

General patients to pay $5 more and concessional patients 80¢ more for prescription drugs.

Billions slashed from hospitals, which will be free to charge for emergency department

Foreign Affairs

Foreign aid frozen at current levels for two years, helping save $7.6 billion over five years

International commitment to spend 0.5 per cent of gross national income on foreign aid abandoned

$400 million saved over four years by folding the former AusAID into the Foreign Affairs Department

Education

Complete deregulation of university fees

Commonwealth funding extended to students at TAFEs, private colleges and sub-bachelor degrees at a cost of $820 million over three years

Labor’s ‘Gonski’ school funding commitments scrapped from 2017-18 with school funding indexed to inflation from 2018

School chaplaincy program continued at a cost of $243.5 million over five years

Retirees

Age pension age to reach 70 by July 1, 2035

Pension means test thresholds to be frozen for 3 years

Tougher income test for self funded retirees to receive Commonwealth Seniors Health Card

Welfare

Enforced six month waiting period for under-30s signing on for the dole. After first six months on dole they will again be cut off for a six month period

Tightened eligibility criteria for disability support pensioners under 35

New start recipients aged between 22 and 25 will be pushed back onto the lower-value Youth Allowance (other) payment

Fuel

The government will reintroduce the twice annual indexation of fuel excise to the Consumer Price Index from August 1 this year.

High income earners levy

A 2% levy will apply to those earning income above $180,000. The impost is for three years only from 1 July 2014 to 30 June 2017 and means that those earning above $180,000 will pay the extra 2% levy on all income in excess of $180,000.

Business gains and losses

The Government remains committed to cutting the company tax rate by 1.5% from 1 July 2015. For large companies this will offset the cost of the Government’s Paid Parental Leave Levy. For the SMEs it will provide a boost to profits.

The Government has also reinforced its promise to repeal the Minerals Resource Rent Tax (MRRT) and Carbon Tax.

For more information please click on The Federal Budget Webpage