Category: Newsletters

Introducing YML Group’s New Live Q&A Online Feature

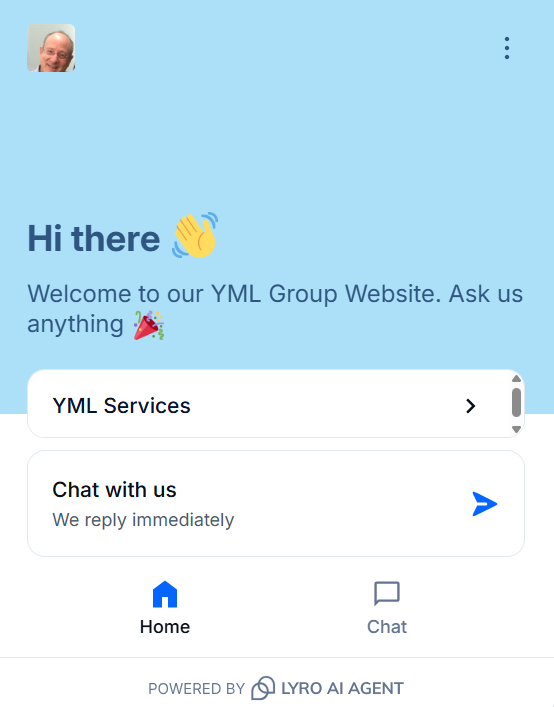

YML Group’s new Live Q&A online assistant is driving the next step in our digital transformation. We are moving confidently into the Artificial Intelligence (AI) era, committed to strengthening our AI offering to you and enhancing your online experience with YML Group.

Introducing our Live Q&A online assistant on our YML Group website, you will find this intelligent, AI-powered tool is designed to provide you with instant answers, streamlined interaction with us and a more intuitive, responsive digital experience.

You will engage with our smart virtual assistant through a conversational, easy-to-use interface, whether you are looking for information about our services, have a question, or simply want to explore and browse our offers. Our virtual assistant is available anytime to guide you, and is a faster, more convenient way to connect with us.

We have a mission to remain at the forefront of technology and to continue to modernise how we serve you and our broader community.

Our Invitation to You

We invite you to now visit our website – www.ymlgroup.com.au/ai – and try out our new Live Q&A online feature. Please enjoy this dynamic and fresh digital enhancement to our important and valued customer service.

How can YML help?

Talk to our YML Chartered Accountants today to see how YML Group can assist you with our new Live Q&A. For more information, view our website and contact us on (02) 8383 4400 or by using our Contact Us page on our website.

What Australia’s recent Age Pension and Deeming Changes mean for your Retirement

Important updates came into effect on 20 September 2025 that may influence the Age Pension entitlement or eligibility for key senior concessions. Recipients of the Age Pension and self-funded retirees may be impacted by four key changes:

1. Deeming Rate Increases

The most significant change is a 50-basis point rise in deeming rates used by Centrelink in the income means test.

Deeming rates are a notional or ‘assumed’ income rate applied to financial assets. Using a deeming rate is a simple way for the Australian Taxation Office (ATO) to calculate income without needing to track actual investment returns.

Deeming rates have been frozen for the past five years as part of the COVID-19 response. This increase is an adjustment to reflect current market conditions more accurately, even though interest rates may be easing.

New deeming rates from 20 September 2025:

Low deeming rate increases from 0.25% to 0.75%; and

the higher (standard) deeming rate will increase from 2.25% to 2.75%.

The low rate applies to the first $64,200 of financial assets for a single pensioner and the first $106,300 for a pensioner couple. Any amount above these thresholds is deemed at the higher rate.

As an increase in the deeming rate means more income is deemed to have been earned from financial assets, this will generally lead to a reduction in the Age Pension. For every $1,000 of financial assets, a fortnightly Age Pension could decrease by $2.50.

2. Age Pension Increase

The maximum Age Pension amount will increase, providing a boost to all pensioners.

New maximum fortnightly payments from 20 September 2025:

For a single pensioner, there will be an automatic increase of $29.70 to $1,178.70; and

for a pensioner couple, there will be an automatic increase of $44.80 to $1,777.00 ($880.50 each).

3. Part-Pension Cut-Off Limits Rise

The maximum income you may earn before losing eligibility for a part Age Pension has been raised. This is a direct result of the increase to the Age Pension.

New fortnightly cut-off limits are:

For a single pensioner, an increase of $59.40 to $2,575.40; and

for a pensioner couple, an increase of $89.60 to $3,934.00 (combined).

4. Commonwealth Seniors Health Card (CSHC) Income Limits Rise

Self-funded retirees who do not qualify for the Age Pension may benefit from this valuable card which provides access to cheaper medicines and other state-based concessions.

New annual income limits for CSHC are:

For a single person, an increase of $2,080 to $101,105; and

for a couple, an increase of $3,328 to $161,768 (combined).

TIP: If your income was previously just above the old limit, you should consider applying for the CSHC. Notably, the CSHC has no assets test, making it particularly beneficial for retirees whose assets disqualify them from the Age Pension.

Next Steps

Before jumping into implementation of any financial strategy, speak to a financial adviser about your personal circumstances to ensure decisions are made that align with your retirement objectives.

How can YML help?

Talk to our YML Financial Planning today to see how YML Group can assist you with your retirement entitlements. For more information, view our website and contact us on (02) 8383 4444 or by using our Contact Us page on our website.

Are you paying too much Land Tax?

Land Tax in New South Wales is an annual charge on the ownership of land (property), calculated as at midnight on 31 December each year.

The NSW Valuer-General assesses and determines the unimproved land value, and the tax is calculated using the average of the current and previous two years’ values to account for fluctuations.

It is payable by individuals, companies and trustees who own taxable property, although exemptions may apply. Common exemptions include a principal place of residence, primary production land, and property used for charitable purposes.

Early in each new calendar year, valuation assessments are issued, and landowners are generally required to pay their Land Tax obligation within 30 days. Instalment plans can be arranged, but there are penalties, such as interest payments and or debt collection, for failure to pay on time.

What to do if you believe your Land Tax liability is too much?

If you deem a Land Tax assessment is incorrect or is unexpectedly too high, you may challenge the Valuer-General’s land value of your property by lodging an objection with the Australian Taxation Office (ATO).

Lodging an appeal and requesting a reassessment can result in significant savings for landowners. Some successful challenges have been based on errors in comparable sales, zoning assumptions, and incorrect treatment of the land’s ‘highest and best use’ in relation to market value.

It is important to seek property valuation advice and prepare evidence for an appeal, but an objection can be an effective strategy leading to a reduced Land Tax liability.

Next Steps

YML Group can review your Land Tax liability and help you determine whether an appeal to the ATO might be a worthwhile step for you to take to mitigate your Land Tax obligation.

How can YML help?

Talk to our YML Chartered Accountants today to see how YML Group can assist you in your Land Tax obligation. For more information, view our website and contact us on (02) 8383 4400 or by using our Contact Us page on our website.

Personal Residential Property Asset Acquisition for your SMSF

The question: Can our SMSF acquire a residential property from us personally? requires a follow-up question: How is the property used?

Before answering these questions, you will require an explanation of Business Real Property (BRP) which is defined under Section 66 of the Superannuation Industry (Supervision) Act 1993 as “any freehold or leasehold interest in real property where the property is used wholly and exclusively in one or more businesses.”

This definition hinges on use, not the type or zoning of the property, and the Australian Taxation Office (ATO) clarifies that even a property that looks ‘residential’ can qualify as BRP if it is genuinely used in the operation of a business. Conversely, a commercial property might not quality as BRP if it is partly used for private purposes.

Therefore, under section 66, a property’s eligibility as BRP depends entirely on its current use in a genuine business operation, not on its appearance or zoning.

If a property satisfies the BRP test, it can be acquired by an SMSF from a related party — provided the transaction occurs at market value.

This allows business owners to transfer premises used in their business into their SMSF, helping free up capital while retaining operational control through a lease arrangement.

However, if the property is not wholly and exclusively used in a business, section 66 prohibits the transfer, and a SMSF might risk breaching the Superannuation Industry (Supervision) Act 1993.

Section 66 Exemption - Examples

The exemption under Section 66 is tested at the time of acquisition. If a property is used, for example, by a doctor, accountant or dentist, 100 per cent of the time for their business with no residential purpose, then the property would be classified as BRP and may be acquired from a related party to a SMSF.

However, if, for example, a property is a working farm that has a farmhouse used residentially, then the farmhouse portion could be considered incidental, and the property may also be acquired from a related party to a SMSF.

Furthermore, a motel that has a manager’s quarters within the property could also be considered incidental, and the property may also be acquired from a related party to a SMSF.

Next Steps

If you are considering a property transaction involving a SMSF and a related party, it is essential to assess the property's current and intended use — not just its type or zoning. Would you like help evaluating a specific property scenario? Ask us at YML Super Solutions to look more closely at the exact details of a property’s use for your SMSF strategy.

How can YML help?

Talk to our YML Super Solutions Team today to see how YML Group can assist you with your SMSF. For more information, view our website and contact us on (02) 8383 4444 or by using our Contact Us page on our website.

Do you need help buying your perfect property?

What is a Buyer’s Agent?

A buyer’s agent, also known as a buyer’s advocate, is a licensed processional who represents the interests of property buyers. A buyer’s agent works exclusively with you, the purchaser, to help you identify, negotiate for and purchase property that fulfils your property-buying criteria.

Unlike a traditional real estate agent, a buyer’s agent does not work on behalf of the vendor (seller) of a property. S/he ensures that their clients are provided with a bespoke property search-and-find service.

Why use a Buyer’s Agent?

A buyer’s agent will work with you to ascertain your property-buying objectives, such as location, property type, budget, growth vs yield, investment vs owner-occupancy. Once a brief is established, a buyer’s agent will search for properties that match your brief, including any off-market options that are not publicly advertised.

Buyer’s agents have networks of contacts in the real estate industry. Their insights and research access can provide you with local market information, trends and risks, giving you an advantage in a competitive market. Operating across Australia, a buyer’s agent can also help you invest in property beyond your local area.

Advocating for you during the negotiation process, coordinating due diligence, managing inspections and reviewing documentation, a buyer’s agent provides their expertise and experience whilst saving you time and energy.

A buyer’s advocate is always in your corner until you have secured a property that aligns with your personal, business, lifestyle and/or investment needs.

What is the current state of the Australian Residential Housing Market?

Generally, in Australia today, residential property values continue to rise at a moderate pace, with the national dwelling value growth rising towards 5 per cent over recent months.

Property analysts had forecast moderate national growth throughout 2025, rather than a fast-rising boom, however supply remains constrained in many Australian regions which supports values and makes for a more competitive market for buyers.

Next Steps

YML Group can partner you with our trusted Property Buyer’s Agent associate to ensure a convenient, efficient and tailored approach to help you in your property search.

When you least expect it, our affiliated Property Buyer’s Agent could present to and secure for you the ideal property that aptly fits within your wealth-building strategy.

How can YML help?

Talk to our YML Chartered Accountants today to see how YML Group can assist you in your property search. For more information, view our website and contact us on (02) 8383 4400 or by using our Contact Us page on our website.

How YML Offshore Co-sourcing can work for your Business

YML Group offers offshoring and co-sourcing solutions to help Australian businesses reduce operational costs and scale efficiently without compromising quality or control. YML provides skilled offshore professionals who work as part of your company’s team, managed and supported by YML’s Australian systems and infrastructure with full accountability.

Specifically, co-sourcing is a hybrid model, a collaborative strategy, combining your existing in-house resources with an external service provider to manage certain functions. This mutual partnership enables your business to focus on its core operations while delegating skilled- and process-based tasks to trained offshore specialists.

Some examples of the types of specialists available to assist your business are:

Offshore Property Manager

An offshore Property Manager operates as an extension of a real estate or property management business in Australia.

Their responsibilities might include calling tenants regarding rent arrears, lease renewals, inspections and maintenance issues, as well as managing property databases and data entry in your property management software.

This setup enables your Australian property managers to focus on client relationships and business growth while an offshore Property Manager handles the day-to-day coordination and communication tasks.

Offshore Quality Engineer

An offshore Engineer supports relevant Australian businesses by ensuring consistent quality assurance processes and documentation.

Their responsibilities might include conducting remote compliance checks and process audits, providing data analysis, and using digital tools to monitor performance.

Australian businesses gain collaborative access to technical expertise while maintaining quality standards for their clients.

Offshore Administrative Support

An offshore administrative professional handles general office, finance, and customer service functions for businesses in Australia.

Their key responsibilities might include managing email correspondence, data entry and document preparation, processing invoices, preparing quotes and reconciliations, all under local, onshore supervision. Administrative staff can also specifically support HR and payroll functions.

Your Australian administrative staff are freed up to focus on clients and strategy due to improved efficiency from the streamlining of back-office tasks.

Next Steps

YML Group can help you gain access to skilled professionals who will integrate seamlessly with your business’s operations, as part of your own team and in alignment with your business, delivering productivity and cost savings.

Our offshore co-sourcing service offers you operational control and is ideal for growing Australian businesses.

How can YML help?

Talk to our YML Business Services Team today to see how YML Group can assist you with offshoring and co-sourcing solutions. For more information, view our website and contact us on (02) 8383 4455 or by using our Contact Us page on our website.

Business Owners – Are you paying the Superannuation Guarantee to your Contractors?

If you are an Australian business owner and you are trying to work out if you must pay superannuation guarantee (SG) contributions to independent contractors, then firstly you need to know their status under the Superannuation Guarantee (Administration) Act 1992.

It is important to know that having contractors with an ABN who issue your company with invoices does not automatically remove your SG obligation. If a contractor is not an employee of your organisation, then you will need to consider if they are deemed to have ‘common law employee’ status for the purpose of paying SG contributions.

SG contributions are generally payable to a contractor who:

- Has an ABN and issues an invoice for work performed

- Performs work personally and does not or cannot delegate their work

- Is engaged wholly or principally for their personal labour and skill (and only partially or not at all for equipment and materials), their labour and skill making up more than 50% of their contract or invoice value

- Is engaged to work on an hourly basis (time) and not for achieving a specific outcome, result or project (product)

SG contributions are generally not payable to a contractor who:

- Is paid to achieve a result (product), not just provide labour (time)

- Does not work as an individual but rather is a company, trust, or partnership

- Delegates the work to others

If a contractor is running their own business, supplying their own staff, tools, materials and bearing business risks, the obligation to pay SG may not apply.

However, business owners who get it wrong and fail to pay SG are at risk of:

- Being corporately liable for the Superannuation Guarantee Charge (SGC), plus interest and administration fees

- Incurring Australian Taxation Office (ATO) penalties, such as fines, for non-compliance

- Being personally liable as Director/s of your company for any unpaid SG

To get it right as a business owner, you will need to:

- Review your contractor arrangements and assess whether SG applies

- Ensure SG contributions are processed timely – schedules and deadlines are adhered to – and reported accurately – keep records for ATO compliance (through SuperStream)

- Work closely with your bookkeeper or accountant to mitigate the risk of SGC and ATO penalties for unnecessary non-compliance

Next Steps

Keep your business running smoothly and reach out to YML Business Services TODAY for our bookkeeping services. We help you stay on top of the rules surrounding Superannuation Guarantee (SG) and independent contractors. Our bookkeeping team is here to support you with accurate and timely management of your SG payments.

How can YML help?

Talk to our YML Business Services Team today to see how YML Group can assist you with your SG obligations. For more information, view our website and contact us on (02) 8383 4455 or by using our Contact Us page on our website.

NEW Work Test for Retirees – What it means for you

Australia’s ‘work test’ must be met by Australians who have reached 67 years of age and want to make voluntary superannuation contributions for which they will claim a tax deduction.

A new rule states that the ‘work test’ no longer must be met by anyone under 75 who wishes to make voluntary contributions to their superannuation accounts, unless they want to claim a tax deduction.

What is the Work Test?

The ‘work test’ requires that anyone aged 67 to 74 years of age must work at least 40 hours within 30 consecutive days in a financial year to be eligible to make voluntary superannuation contributions, such contributions payable at any time within the same financial year as the work is completed.

This ‘work test’ was removed for non-concessional (after tax), salary sacrifice and voluntary employer contributions for people aged 67 to 74 years of age. However, the ‘work test’ remains if you want to claim a tax deduction for personal deductible contributions.

Being ‘gainfully employed’ forms part of the criteria to meet the ‘work test’. Gainful employment means receiving gain or reward and may include remuneration such as salary, wages, directors’ fees, business income, bonuses, commissions, fees or gratuities which have been obtained in return for personal exertion.

Unpaid work does not qualify as being ‘gainfully employed’.

The term ‘gainfully employed’ once unfairly excluded company directors and officeholders in non-traditional employment roles, but a new tax law draft restores eligibility meaning that directors and officeholders may claim a tax deduction on voluntary superannuation contributions if they meet the 40-hour ‘work test’ (or exemption – see Note). This draft change is already in effect.

Any director of a company (including non-executive directors who do not engage in the day-to-day management of an organisation) is specifically included as an employee for Superannuation Industry (Supervision) Act 1993 (‘SIS Act’) purposes, provided that a director is entitled to payment for their work as a company director.

Work may be undertaken offshore, although residency matters may arise.

Note: There is a ‘work test’ exemption, applicable only once per individual and then may not be used again. It is applied for those people recently retired with superannuation total balances at the previous 30 June of under $300,000.

How can YML help?

Talk to our YML Super Solutions Team today to see how YML Group can assist you with your SMSF. For more information, view our website and contact us on (02) 8383 4444 or by using our Contact Us page on our website.

What you MUST know about selling your Main Residence

What you need to know about Capital Gains Tax (CGT) when selling your Home

Capital Gains Tax (CGT) implications when selling your home (‘main residence’) must be addressed because unless you qualify for the main residence exemption, CGT may be triggered. CGT applies when you sell an asset for more than you paid for it. Any gain is added to your assessable income and taxed at your marginal rate.

The full main residence exemption, however, allows you to disregard any capital gain (or loss) when selling your home if the following criteria apply:

- You are a resident of Australia

- You lived in the property for the entire ownership period

- The property was not used to produce income (via rental or running a business)

- The land itself is less than two (2) hectares

If you sell vacant land, intending to build on it but not yet having done so, the main residence exemption generally is not available.

Partial CGT Exemption if you rented out your Home before selling

If you rented out your home, the Australian Taxation Office (ATO) allows you to treat the property as your main residence for up to six (6) years whilst it is rented out, so long as you have not nominated another property as your main residence during this time.

Renting out your home means full CGT exemption will not apply. You will need to apportion any capital gain and may be eligible for a partial CGT exemption.

Main Residence Exemption if you leave your Home vacant before selling

Leaving your home vacant, so long as you have not nominated another property as your main residence, allows you to treat the property as your main residence indefinitely, thus qualifying for the main residence exemption, assuming all relevant criteria are met.

Can I claim the Main Residence Exemption if I’m residing overseas at the time of selling?

If you are a foreign resident for taxation purposes at the time of sale of your home, generally, you may not claim the main residence exemption, even it the property was your home when you were living in Australia prior to living overseas.

If you have been a foreign resident for a continuous six (6) years or less during your Australian property ownership period, and one of certain qualifying life events has occurred (such as, for example, a terminal illness or a death in your immediate family, or a formally-agreed relationship termination), then you may satisfy the life event test which may result in your qualifying for the main residence exemption.

Note, foreign residents are subject to Foreign Resident Capital Gains Withholding (FRCGW), a 15% withholding tax on the sale price of their Australian property, adjusted accordingly when you have lodged your annual tax return.

The ‘Interest-deductibility Test’ and how it affects the Main Residence Exemption

If any part of your home is or was used to produce an income (via rental or running a business) and you would therefore be eligible to deduct interest on your home loan, then you may not qualify for the full main residence exemption.

The part of your home used exclusively to produce an income may allow you to claim a proportionate interest deduction.

However, if the home loan used to purchase the property is not solely in the owner’s name, interest deductibility may be denied unless you, the owner, can prove that you are legally responsible for the home loan, and the property or part thereof was used to produce an income (via rental or running a business).

What do I need to report to the ATO in my annual Tax Return?

Whether you expect a full or partial main residence exemption, you have reporting obligations, including:

- Electing eligibility for full or partial main residence exemption, if applicable

- Declaring any rental income earned from renting out part or all the property

- Claiming an interest deduction on the portion of the property used to generate an income

- Using your records to declare purchase price, move in and out dates, rental and business use (income-generation) periods, and accurate proportions of relevant interest and associated expense deduction claims

- Declaring whether you were an Australian or a foreign resident at the date of sale

- Claiming satisfaction of any life event test (if you were a foreign resident)

- Selecting the correct exemption code: “I: Main residence exemption (Subdivision 118-B)”

- Using “Property transfer” data already available to support CGT reporting

Next Steps

Contact YML Chartered Accountants for tailored advice about selling your home (‘main residence’), especially if selling your home involves rental periods, foreign residency, or shared ownership.

How can YML help?

Talk to our YML Chartered Accountants today to see how YML Group can assist you with your CGT obligations. For more information, view our website and contact us on (02) 8383 4400 or by using our Contact Us page on our website.

YML Doubles Down on AI: Investing in the Future of Intelligent Innovation

YML is proud to announce its strategic investment and commitment to expanding its Artificial Intelligence (AI) capabilities through the launch of a dedicated AI division. This bold move responds to the accelerated growth of AI technology and focuses on rapid development cycles to deliver practical, high-impact solutions to everyday business challenges.

Building on our proven success in Robotic Process Automation (RPA), this new chapter marks a significant step forward in our mission to provide intelligent, transformative solutions for clients across industries.

A Natural Evolution from RPA to AI

YML’s success in RPA has already shown our ability to streamline repetitive processes, improve productivity, and reduce operational costs. Now, YML AI will take this further — applying breakthroughs in generative AI, natural language processing, and data analytics to solve more complex and dynamic problems.

This evolution allows us to offer a complete spectrum of intelligent automation, from process optimisation to predictive decision-making.

Leadership Driving Innovation

To lead this initiative, we are excited to welcome Avi Sharabi, a senior technology executive with over three decades of experience in cutting-edge technologies. Avi has established and led the Deloitte Sydney Analytics, and later on led the KPMG Sydney data team in his 12 year tenure as a Senior Partner. During these times and afterwards, Avi drove innovation in both corporate as well as startup environment. in his role as a Lead Partner for over 12 years. innovation at both corporate and startup levels.

His AI journey dates back to 1995, when fresh out of Uni, he developed a Machine Learning (ML) solution enabling GE Nuclear Energy to address a heating reactor challenge. Today, at YML AI , Avi is building and leading a team of AI professionals dedicated to delivering measurable results for our clients.

Solving Real Problems, Fast

At the core of YML AI is rapid prototyping — creating and testing solutions quickly so clients can see value early in the process. Based on our experience and initial conversations with business leaders we are prioritising high-return applications of AI in areas such as:

- Document Intelligence – Extracting and organizing information to reduce manual processing

- Agentic Workflows – Building intelligent assistants that identify bottlenecks, automate decisions, and handle complex processes within your existing work environments (e.g. MS Outlook).

- Data Analysis & Insights – Finding patterns and generating actionable insights from complex information resulting increased profitability, expansion of market footprint, maximising available resources

- Customer service support – analysing omni channel (email, phone, chat, etc.) interactions with customers, defining best resolution approach, measuring (customer success), and evolving service

Investing in the Future

To ensure the success of YML AI, we made significant investments in:

- Talent – Building a team of experienced data scientists, AI engineers, and domain experts.

- Technology – Partnering with leading providers to leverage industry leading AI technologies.

- Speed & Scalability – Developing reusable AI artefacts to accelerate delivery

Your Challenges, Our Next Breakthrough

Our AI vision is fuelled by real-world challenges. We invite our clients and partners to share with us the challenges they face - whether in accounting, logistics, marketing, sales, or beyond. Jointly, we can design solutions that deliver immediate value and long-term growth.

How can YML help?

For more information, please contact:

Avi Sharabi

CEO - YML AI

M: 0410 348 297

E: Avi.Sharabi@ymlgroup.com.au

W: www.ymlgroup.com.au