Month: February 2026

Beyond ChatGPT: Why Custom AI Agents Are the Next Evolution in Workflow Automation

From Conversation to Action: How YML Group is Deploying AI That Seamlessly Integrates Within Your Systems

If your team is using ChatGPT, Claude, or other LLM tools, you've likely experienced the productivity boost they provide. But you've also probably hit their limitations: copying and pasting between systems, manually transferring information, and watching AI-generated insights sit unused because they're disconnected from your actual workflows.

At YML Group, we're moving beyond conversational AI to deploy custom AI agents that integrate seamlessly into business operations – and we're implementing them internally first.

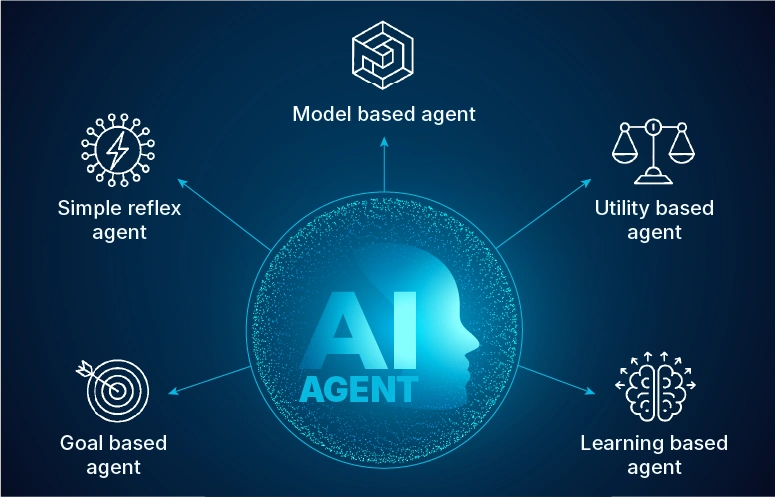

The Difference Between AI Tools and AI Agents

Out-of-the-box LLM subscriptions are powerful for:

- Drafting content and emails

- Answering questions

- Analysing data you manually provide

- Ideation and brainstorming

Custom AI agents integrated within business processes extend these capabilities by:

- Connecting directly to your data ecosystem — integrating with internal and external data sources including CRM platforms, databases, knowledge bases, and core business systems to access real-time information

- Making smarter decisions over time — analysing data patterns, learning from outcomes, and progressively improving recommendations and actions based on your business results

- Taking action without manual intervention — executing tasks autonomously on your behalf through secure API integrations, from updating records to triggering workflows

- Embedding into your existing processes — operating as a native part of your workflows rather than requiring you to switch between tools or manually transfer information

- Adapting to your unique operations — learning from your specific business context, industry terminology, compliance requirements, and operational rules to deliver tailored results

- Orchestrating complex workflows — automating entire multi-step processes end-to-end, coordinating tasks across systems and team members without human oversight

Think of a custom AI agent as a tireless team member who inherently understands your systems, has instant access to your data, operates with your business logic, and executes tasks autonomously while you focus on strategic work.

Walking the Walk: YML's Internal AI Implementation

At YML, we practice what we preach. We've examined multiple accounting operations that drive our business and are building AI agents to improve internal operations, reduce manual errors, and increase the quality of services we deliver to you.

Use cases we're currently implementing:

Improving Process Efficiency

- Automate job workflow management by intelligently routing tasks and tracking status

- Optimise delivery schedules by analysing workload balance, proactively identifying bottlenecks, and devising mitigation strategies to reduce risk

- Handle document collection and ingestion by monitoring email inboxes, extracting relevant financial documents, categorizing them by client and type, and preparing them for processing

Reducing Errors

- Pre-process financial data by analysing documentation, extracting key information, and structuring it for review

Improving Customer Interaction

- Generate draft communications to clients regarding missing documentation, status updates, and routine inquiries based on current job status

These use cases represent the kind of transformation we see as possible across professional services: turning hours of manual coordination and data entry into automated processing, freeing teams to focus on higher-value advisory work and complex problem-solving.

Our Approach: Built for Your Business

- Understand your business-specific pain points and overall aspirations

- Define specific, tangible objectives aligned to your organizational roadmap (ensuring adoption)

- Approve use cases and sequence of implementation

- Assess your systems landscape and align a solution architecture that fits your technology stack

- Design and approve the solution

- Integrate data sources securely

- Develop and train the AI agent

- Test thoroughly in controlled environments

- Manage change through education, training, and clear communication

- Deploy in a phased approach

- Continuously improve by monitoring performance, refining training, innovating, and deploying enhancements

Ready to Explore What's Possible?

If your team is ready to move to AI agent-enabled workflows, we'd love to discuss your current challenges and future aspirations.

We're building this future for ourselves at YML Group, and we're ready to build it with you.

Want to learn more? We're offering complimentary workflow assessments to explore where AI automation could deliver the most value for your organization.

Contact us to schedule your assessment and discover how custom AI agents can transform your operations.

How can YML help?

- Avi Sharabi

- CEO – YML AI

- M: 0410 348 297 ·

- E: Avi.Sharabi@ymlgroup.com.au

- W: www.ymlgroup.com.au

Could you purchase a Property for your SMSF?

A SMSF with around $250,000 could potentially give you enough to cover your setup and ongoing compliance costs, provide a deposit for a property and maintain liquidity for fees and future diversification.

Buying a property for your SMSF has its pros and cons. We outline them here:

PROS

Tax advantages:

- Rental income is generally taxed at 15% which is often lower than your personal marginal tax rate

- Capital gains tax (CGT) on property held longer than 12 months is effectively 10%

- Once you enter pension phase, both rental income and CGT can become tax-free

Borrowing leverage:

- SMSFs can use Limited Recourse Borrowing Arrangements (LRBAs) to buy property, enabling you to buy a larger asset than your SMSF balance alone would allow

Rental income boosts your SMSF:

- Rent paid by tenants goes directly into your SMSF

- Commercial property can be leased to your own business at market rates

Long-term capital growth:

- Growth of a property asset inside a SMSF is magnified by concessional tax treatment

CONS

Tight Australian Taxation Office (ATO) compliance:

- Mistakes can be costly

Less flexibility:

- Property ties up a large part of your SMSF, making diversification harder

Loan restrictions:

- SMSF loans often have higher interest rates and stricter conditions

No personal use:

- Your family and you may not live in or use a property bought for your SMSF

Learn more about how we can help you by calling us on (02) 8383 4466 and requesting a callback or making an appointment with the YML Finance Team.

How can YML help?

Talk to our YML Finance Team today to see how YML Group can assist you with SMSF property purchases. For more information, view our website and contact us on (02) 8383 4466 or by using our Contact Us page on our website.

Challenging the Valuer-General’s Valuation of your Land

Australian landowners often assume a land valuation is final, but many assessments can be successfully disputed. Land Tax is one of the key property-related obligations in Australia, and it is based on a valuation undertaken by the Valuer-General who does not typically visit every property to ascertain unique features. Therefore, you might have cause to challenge the Valuer-General’s assessment.

The Valuer-General relies heavily on a mass-appraisal method, which prioritises efficiency over site-specific accuracy. This Mass Valuation model often means that individual blocks of land are not assessed with consideration for a block’s attributes and constraints.

Mass-appraisal uses the recent sales of chosen ‘benchmark’ properties – based on location, zoning and land use – to calculate a one-size-fits-all percentage change in valuation; and assumes a valuation of vacant land at its ‘highest and best use’.

This method is efficient – it assumes your property is identical to the ‘benchmark’, but it does not reflect those attributes – easements, environmental factors such as contamination, topography such as steep slopes, restrictive overlays such as heritage limitations, among others – which are not shared by grouped ‘benchmark’ properties.

What this means for you

Mass Valuation could give you valid grounds for an objection to a land tax liability that you deem to exceed your land’s individual valuation. However, to succeed, an objection must show a quantifiable error such as:

- Incorrect market value (at the valuation date)

- Wrong land size, boundaries, or zoning restrictions

- Incorrect parcel apportionment

- Failure to consider constraints (including limited ‘highest and best use’ for vacant land)

How to build a strong objection

You may not object simply because your Land Tax liability has increased. You may object if there is a mathematical error.

Strong objections use legal discovery to report errors, and ensure the following:

- Comparable sales evidence – at least three (3) similar sales around the valuation date and adjusted to reflect land-only value

- Documented site-specific disadvantages – constraints identified that the mass-appraisal missed

- Timely lodgement of objection – within 60 days from the date of notice

Examples of successful challenges

Australian courts have repeatedly overturned Valuer-General-assessed valuations when assumptions under the mass-appraisal method fail.

Here are some recent Australian court decisions which show how land valuations can be dramatically reduced when constraints are considered, instead of ignored or misinterpreted:

- Hammock Investments (NSW):

o Environmental limits reduced value from $8M to $810k - Perisher Blue (NSW):

o National Park lease restrictions cut value from $39M to $14M - WSTI Properties (VIC):

o Heritage overlay reduced value from $6.2M to $2.925M - Goldmate Property (NSW):

o Compulsory acquisition value increased from $0 to $9.5M after zoning errors were corrected

Lodging an objection and requesting a reassessment can result in significant savings for Australian landowners.

It is important to seek property valuation advice and prepare evidence for an appeal, but an objection can be an effective strategy for paying less Land Tax.

Next Steps

YML Group can review your Land Tax liability and help you determine whether lodging a dispute with Revenue NSW might be a worthwhile step for you to take to mitigate your Land Tax obligation.

How can YML help?

Talk to our YML Chartered Accountants today to see how YML Group can assist you in your Land Tax obligation. For more information, view our website and contact us on (02) 8383 4400 or by using our Contact Us page on our website.