Month: December 2025

Introducing YML Group’s New Live Q&A Online Feature

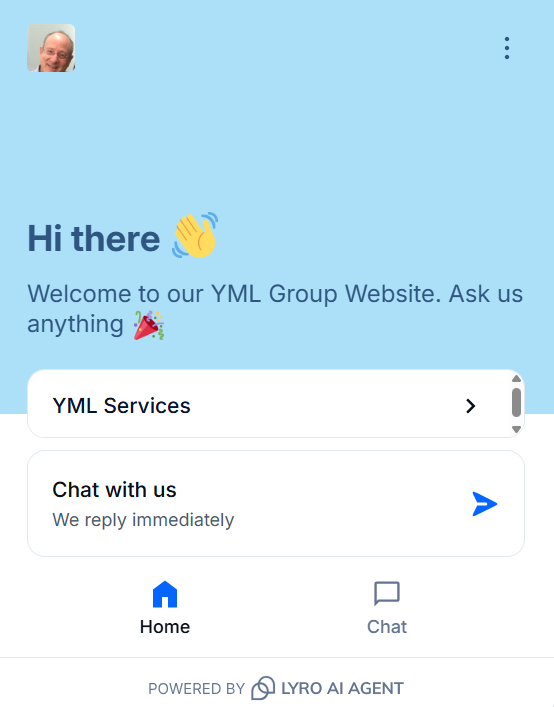

YML Group’s new Live Q&A online assistant is driving the next step in our digital transformation. We are moving confidently into the Artificial Intelligence (AI) era, committed to strengthening our AI offering to you and enhancing your online experience with YML Group.

Introducing our Live Q&A online assistant on our YML Group website, you will find this intelligent, AI-powered tool is designed to provide you with instant answers, streamlined interaction with us and a more intuitive, responsive digital experience.

You will engage with our smart virtual assistant through a conversational, easy-to-use interface, whether you are looking for information about our services, have a question, or simply want to explore and browse our offers. Our virtual assistant is available anytime to guide you, and is a faster, more convenient way to connect with us.

We have a mission to remain at the forefront of technology and to continue to modernise how we serve you and our broader community.

Our Invitation to You

We invite you to now visit our website – www.ymlgroup.com.au/ai – and try out our new Live Q&A online feature. Please enjoy this dynamic and fresh digital enhancement to our important and valued customer service.

How can YML help?

Talk to our YML Chartered Accountants today to see how YML Group can assist you with our new Live Q&A. For more information, view our website and contact us on (02) 8383 4400 or by using our Contact Us page on our website.

What Australia’s recent Age Pension and Deeming Changes mean for your Retirement

Important updates came into effect on 20 September 2025 that may influence the Age Pension entitlement or eligibility for key senior concessions. Recipients of the Age Pension and self-funded retirees may be impacted by four key changes:

1. Deeming Rate Increases

The most significant change is a 50-basis point rise in deeming rates used by Centrelink in the income means test.

Deeming rates are a notional or ‘assumed’ income rate applied to financial assets. Using a deeming rate is a simple way for the Australian Taxation Office (ATO) to calculate income without needing to track actual investment returns.

Deeming rates have been frozen for the past five years as part of the COVID-19 response. This increase is an adjustment to reflect current market conditions more accurately, even though interest rates may be easing.

New deeming rates from 20 September 2025:

Low deeming rate increases from 0.25% to 0.75%; and

the higher (standard) deeming rate will increase from 2.25% to 2.75%.

The low rate applies to the first $64,200 of financial assets for a single pensioner and the first $106,300 for a pensioner couple. Any amount above these thresholds is deemed at the higher rate.

As an increase in the deeming rate means more income is deemed to have been earned from financial assets, this will generally lead to a reduction in the Age Pension. For every $1,000 of financial assets, a fortnightly Age Pension could decrease by $2.50.

2. Age Pension Increase

The maximum Age Pension amount will increase, providing a boost to all pensioners.

New maximum fortnightly payments from 20 September 2025:

For a single pensioner, there will be an automatic increase of $29.70 to $1,178.70; and

for a pensioner couple, there will be an automatic increase of $44.80 to $1,777.00 ($880.50 each).

3. Part-Pension Cut-Off Limits Rise

The maximum income you may earn before losing eligibility for a part Age Pension has been raised. This is a direct result of the increase to the Age Pension.

New fortnightly cut-off limits are:

For a single pensioner, an increase of $59.40 to $2,575.40; and

for a pensioner couple, an increase of $89.60 to $3,934.00 (combined).

4. Commonwealth Seniors Health Card (CSHC) Income Limits Rise

Self-funded retirees who do not qualify for the Age Pension may benefit from this valuable card which provides access to cheaper medicines and other state-based concessions.

New annual income limits for CSHC are:

For a single person, an increase of $2,080 to $101,105; and

for a couple, an increase of $3,328 to $161,768 (combined).

TIP: If your income was previously just above the old limit, you should consider applying for the CSHC. Notably, the CSHC has no assets test, making it particularly beneficial for retirees whose assets disqualify them from the Age Pension.

Next Steps

Before jumping into implementation of any financial strategy, speak to a financial adviser about your personal circumstances to ensure decisions are made that align with your retirement objectives.

How can YML help?

Talk to our YML Financial Planning today to see how YML Group can assist you with your retirement entitlements. For more information, view our website and contact us on (02) 8383 4444 or by using our Contact Us page on our website.

Are you paying too much Land Tax?

Land Tax in New South Wales is an annual charge on the ownership of land (property), calculated as at midnight on 31 December each year.

The NSW Valuer-General assesses and determines the unimproved land value, and the tax is calculated using the average of the current and previous two years’ values to account for fluctuations.

It is payable by individuals, companies and trustees who own taxable property, although exemptions may apply. Common exemptions include a principal place of residence, primary production land, and property used for charitable purposes.

Early in each new calendar year, valuation assessments are issued, and landowners are generally required to pay their Land Tax obligation within 30 days. Instalment plans can be arranged, but there are penalties, such as interest payments and or debt collection, for failure to pay on time.

What to do if you believe your Land Tax liability is too much?

If you deem a Land Tax assessment is incorrect or is unexpectedly too high, you may challenge the Valuer-General’s land value of your property by lodging an objection with the Australian Taxation Office (ATO).

Lodging an appeal and requesting a reassessment can result in significant savings for landowners. Some successful challenges have been based on errors in comparable sales, zoning assumptions, and incorrect treatment of the land’s ‘highest and best use’ in relation to market value.

It is important to seek property valuation advice and prepare evidence for an appeal, but an objection can be an effective strategy leading to a reduced Land Tax liability.

Next Steps

YML Group can review your Land Tax liability and help you determine whether an appeal to the ATO might be a worthwhile step for you to take to mitigate your Land Tax obligation.

How can YML help?

Talk to our YML Chartered Accountants today to see how YML Group can assist you in your Land Tax obligation. For more information, view our website and contact us on (02) 8383 4400 or by using our Contact Us page on our website.